How-to Financing A cellular Domestic when you look at the Georgia

1. Funding a mobile house in the Georgia is going to be problematic, however, there are many possibilities if you know in which to seem. Below are a few such options:

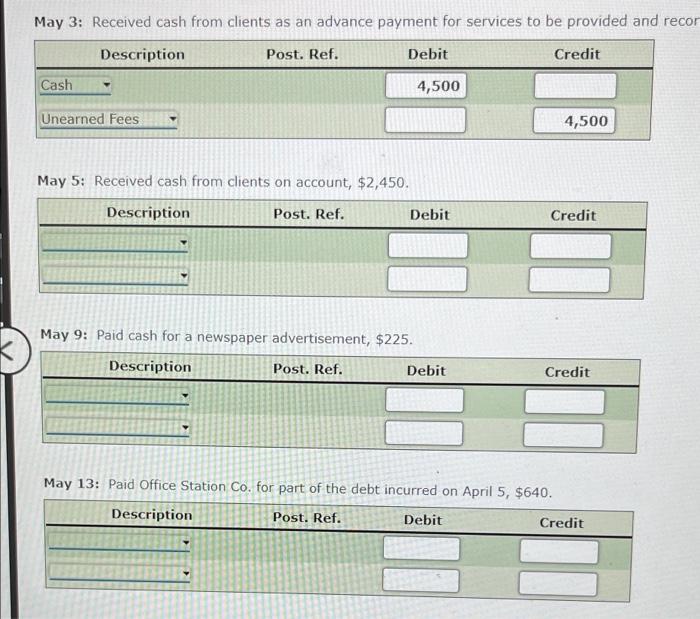

Choice step 1: One to choice for investment a cellular residence is courtesy an individual loan. You can aquire a consumer loan out-of a lender, credit commitment, otherwise on the web financial. The interest rate toward a personal bank loan varies according to their credit history and you can financial situation.

Choice dos: An alternative choice getting money a cellular house is as a consequence of a lender is by using a mortgage. You will have to has actually good credit so you can qualify for home financing, as well as the interest rate might possibly be higher than that have a personal loan. However, you happen to be able to get a lesser rate of interest when the you place down a bigger advance payment.

- The fresh cellular domestic must be at least 400 sq ft or more.

- The new mobile house should have been situated once June fifteen, 1976, and also in satisfy Government Are manufactured Home Design and you may Security Conditions (there’ll be a certificate term because of it).

- Brand new cellular home must be on a permanent foundation and cannot be located when you look at the a cellular house playground.

- The mortgage also needs to coverage the fresh new homes about what the latest are available house lies.

Option step 3: If you’re not sure which finance choice is best for you, communicate with a monetary coach or housing specialist. They’re able to help you know the options and choose a knowledgeable way to finance their cellular domestic.

Now that we’ve got gone over some general guidelines on how to loans a mobile home inside the Georgia, let’s dive towards some information. Once we discussed earlier, that selection for resource a cellular home is owing to your own financing. You can get a consumer loan off a financial, credit relationship.

dos. The way to finance a mobile residence is to find a loan off a financial or borrowing partnership.

If you are investment a cellular home, it is essential to research rates and you may contrast interest rates out-of more lenders. Definitely examine interest levels and you can terminology prior to signing one paperwork before you could commit to things. You need to have the best package you’ll, so be sure to find out about discounts otherwise special deals.

For those who have a good credit score, you might be in a position to qualify for a lower interest. However, should your credit score is not so excellent, you may have to shell out a higher interest. That is why it is important to examine cost from more loan providers prior to you select one to.

You can even be thinking about an extended mortgage title so you’re able to finance the mobile family. This may lower your monthly installments, but you’ll shell out way more when you look at the notice along the lifetime of new mortgage. It’s also a smart idea to get pre-approved for a loan before you start looking a mobile domestic inside Georgia.

>> Check out the top cellular home loans inside the 2022 out-of Investopedia. Mobile Household Moved are a cellular household broker from the state from Georgia providing sensible options for cellular homebuyers!

Just remember that , you’ll likely need to pay an effective large interest rate and may also need to establish a larger downpayment if you fund due to a mobile house broker or broker. However, if you are having trouble bringing acknowledged for a loan, it your best option for you.

cuatro. Constantly have a look at fine print and ask concerns if not see some thing before signing any records.

When you are capital a cellular family, it is important to see every fine print of your mortgage prior to signing some thing. Be sure to check out the conditions and terms and have inquiries if discover everything you don’t understand. You dont want to make any problems which will ask you for more funds in the long run.

If you’re not yes which funding choice is most effective for you, correspond with a financial mentor otherwise an effective Georgia property counselor. They could make it easier to see https://paydayloanalabama.com/woodville/ the options and select an informed means to fix money your own mobile home.

Now that you discover a few of the concepts on financial support good cellular domestic within the Georgia, it is time to begin shopping around for the best offer!

Get more info To your Choices to Sell Your home.

Attempting to sell a house these days should be confusing. Apply to united states or complete their details less than and we will let make suggestions through your possibilities.