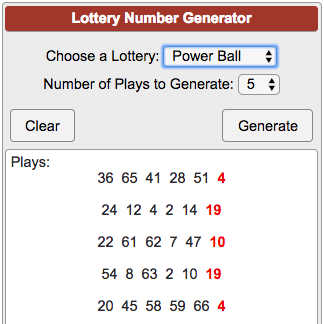

Listed here are just what approximate wide variety may look such as for instance:

A course to possess home buyers who have founded a great credit background but i have not yet spared the necessary deposit otherwise have chosen to make use of the coupons to build assets in almost any implies.

Yes, we realize you to definitely possibly preserving the desired down-payment to own a good new house are problematic. Thankfully that as a result of the all of our home loan financing lovers and you may insurance agencies, you can buy property using nothing of individual coupons. Brand new Borrowed Down-payment financial system produces they possible for one begin to build security in your house without having to keep for a long time.

- All the people need a credit rating from 680 or even more, 750 necessary (how exactly to availability your credit score)

- The revenue is secure and you will – if you aren’t towards the income or guaranteed era – you’ve been with similar workplace(s) for around 24 months

- You’ll find a property that costs no more than 4X your own terrible yearly house taxable income (that will were CCTBs and you may income of a primary family member co-signor)

- The target domestic price is regarding the $500K or reduced

Warning – all the criteria significantly more than are criteria into program, therefore please double-check

Otherwise qualify you’ll have to been up with your own downpayment one other way, possibly gifted of a daddy, sell something, or traditional fashion coupons.

- get a consumer loan or personal line of credit from your own lender for the advance payment funds,

- has united states discover a loan provider for your requirements that can make you home financing using lent advance payment, and you may

- the lending company should be setup to partner with Sagen Canada (similar to CMHC), that will bring financial insurance policies that the financial demands supply your a minimal downpayment financial. Sagen has the Lent Downpayment Insurance policies Program into home loan bank, and is also their requirements that individuals need to fulfill to get this to work for you.

- You have decent borrowing from the bank, which usually means a get off 750.

- You really must have steady money, which have about two years together with your current workplace(s) if the legs occasions otherwise incomes commonly protected.

For every single important mortgage qualifying legislation, for an excellent $300K get you’ll wanted 5% advance payment ($15,000) together with a supplementary step one% ($step 3,000) or more for the closing costs you will find (attorneys, assets review, appropriate taxes, energy connections, etc.). So that you you want home financing for $285,000 and you may a down payment mortgage to own $18,000.

half this is your guarantee) (ex boyfriend 5% notice, twenty-five 12 months amortization) $ 300/mo – the fresh new borrowed down-payment mortgage fees (ex boyfriend. 6% Focus, 5yr identity) $ 175/mo – assets taxes into area otherwise city $ 110/mo – fire/possessions insurance ——— $2400/mo – Total cost Out-of Due Your own house – Evaluate One to So you’re able to Expenses Rent

Guideline Earnings: so you’re able to be eligible for that it home loan, your loved ones taxable income can be on the step 1/next our house speed or even more. $300K/4 = $75K/year since a guideline money. At the same time your own operate need to be secure and very an excellent borrowing from the bank.

Putting it as one – If Borrowed Off or else

Setting a target to truly get your residence is a huge offer and you will an exciting travel. They starts with an aspiration, followed closely by delivering specific very first “discovery” and “exploration” procedures. Will ultimately you earn the initial feel one to “hey, this may be you’ll be able to!” Before long you are looking at residential property, the other go out . it’s swinging big date and you will a destination to telephone call the. I am happy to engage in their travels.

Expertise financial loans is actually a key part on your own package and you can excursion. Locate a property, just be able to be eligible for a mortgage. Your income should be steady and you will adequate to pay your existing expense and the the home loan, your own credit character has to demonstrate that when someone stretches your borrowing from the bank that you outlay cash back promptly so when arranged, and you have to have the expected minimum down-commission, and you may – naturally – that may be hard to rescue in the modern ecosystem. For those having solid a no credit check installment loans Fresno position and you may strong borrowing from the bank, there could be a preliminary clipped having down-payment, hence we chatted about more than, known as Borrowed Down-payment System, so there are also indicates also.

Whenever you satisfy the six, excite over a profile and you will we had be happy to give a keen comparison up on choosing it.